Buy, build, and grow!

Finance your dream equipment: get ahead of your competition

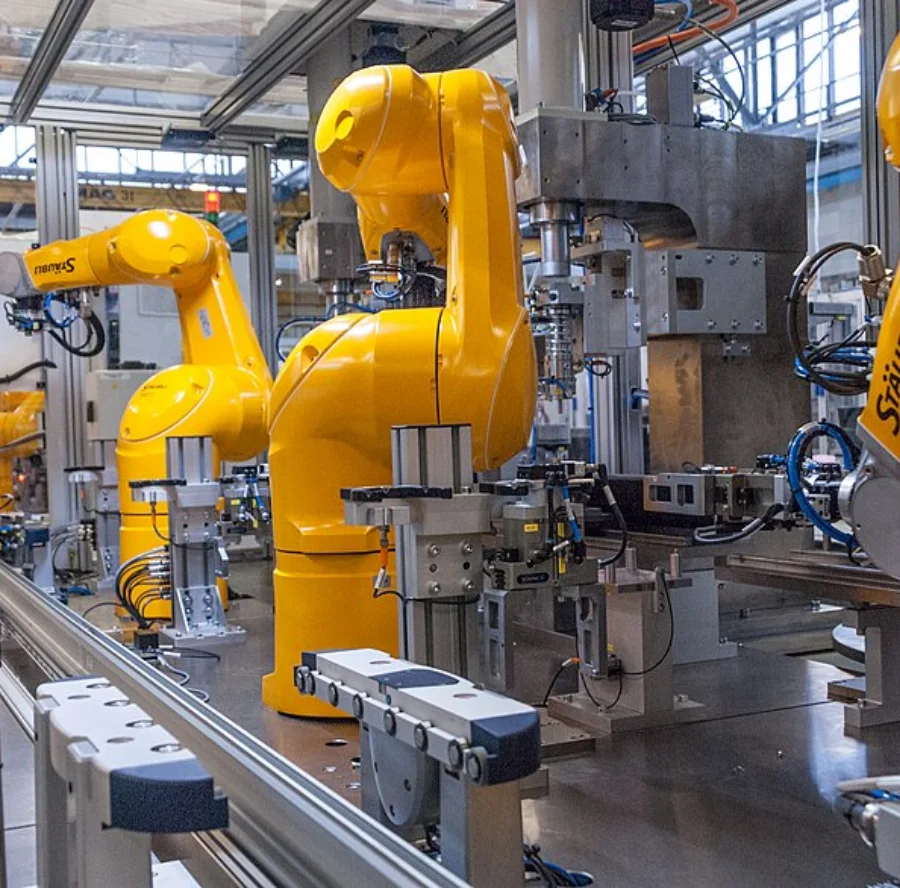

With our equipment financing solution, acquire essential equipment for your business growth.

Apply in minutes

No obligations or hard credit pulls

Boost your competitive advantage with our equipment financing solution!

Equipment financing overview

- Application: Businesses fill out the application form and specify the equipment they want to finance.

- Documentation: Relevant information, along with necessary documents, are provided with the application.

- Evaluation: Our team evaluates the application and documents to make financing decisions.

- Funding: If everything checks out, funds are released for equipment purchase.

- Repayment: Loan repayment is typically made in monthly installments based on the business's cash flow.

- Risk-free financing: No collateral or flawless credit score required; equipment serves as security in case of default.

Determining factors for equipment financing rates

- LTV ratio: Higher LTV (Loan amount vs Equipment cost) means high rates.

- Market conditions: Economic factors like inflation affect rates.

- Loan length: Longer terms have slightly higher rates.

- Equipment type: Specialized gear causes higher rates.

- Credit history: Good credit means lower rates.

When to choose equipment financing and when to avoid it

Choose equipment financing if:

- Need equipment now? Pay later - secure equipment without upfront costs, freeing up cash flow.

- Growing business, tight budget? Invest in growth with monthly payments that fit your budget.

- Tax savings possible? Deduct interest and potentially lower your tax bill.

Avoid equipment financing if:

- Small equipment purchase? Financing costs may outweigh benefits - consider a full purchase.

- Short-term equipment need? Owning might be cheaper than interest payments for short-term use.

- Unpredictable cash flow? Avoid locking into payments if your income fluctuates.

Advantages of equipment financing

- Get latest equipment: Upgrade your equipment today, without huge upfront investment.

- Keep cash flowing: Spread equipment costs & free up cash for other needs.

- Credit line secured: Finance equipment without affecting existing credit lines.

- Fast approval: Get your loan faster compared to other options.

What do we offer?

- Tailored funding: Access $10,000-$20,000,000 equipment needs.

- Expert guidance: Simplifying the process for your ideal loan.

- Swift approvals: Start using your equipment sooner with fast funding.

- Flexible payments: Choose plans suiting your budget and cash flow.

- Dedicated support: Receive ongoing assistance throughout the financing journey.

Operate smarter, expand faster with equipment financing!

Financing options available

0

Expert assistance at your service

0

+

Maximum funding offered

$

0

M

Quick turnaround time

0

Hr